Commercial Collection Agency in Atlanta, GA

Meet Altus, The Experts in Commercial Debt Collection

Start Recovering More With Altus

Start Recovering More With Altus

At Altus, we take the stress out of managing your commercial receivables so you can focus on what matters most: growing your business. With an office right here in Atlanta, we’re proud to be the trusted partner for B2B debt collection and receivables management across Georgia. Whether you’re a small local business or a large enterprise, we bring innovative strategies, unmatched expertise, and a passion for results to every client we serve. From Atlanta to Fulton County and beyond, businesses count on us to recover more, worry less, and keep their cash flow moving. Let’s get your receivables back on track!

Altus is a nationally recognized commercial debt collection agency with a proven track record of delivering exceptional results for businesses of all sizes. We empower Atlanta businesses to focus on growing their operations, leaving the complexities of debt collection and receivables management to our experts.

From recovering unpaid invoices to streamlining receivables through cutting-edge technology, we combine a localized approach with national strength, ensuring every business we serve feels confident and supported. Operating in one of the Southeast’s vibrant economic hubs, our Atlanta office allows us to build personal connections with our clients while understanding the unique needs of this region.

Altus takes pride in being an integral part of Atlanta’s business ecosystem. Whether you’re a thriving small business or a key player in Atlanta’s corporate landscape, we offer customized receivables management services to enhance your financial health.

With our team located right here in Atlanta, we’re able to meet with clients face-to-face to forge meaningful partnerships. Through every collection effort, we prioritize maintaining your business relationships and protecting your reputation while getting the results you need.

If you’re searching for a commercial collection agency in Atlanta that’s committed to helping you recover more and worry less, Altus is your first call. Contact us today to learn how our expert team and localized solutions can resolve your outstanding receivables, streamline your cash flow, and take your business to the next level.

With a physical presence in Atlanta, Altus goes beyond offering debt recovery—our solutions empower businesses to thrive in one of the Southeast’s most dynamic markets. Get in touch today, and experience why Altus is Atlanta’s leading choice for receivables management and B2B debt collection.

We offer a full suite B2B debt collection services designed to help Atlanta businesses manage outstanding receivables effectively. Whether you’re dealing with overdue payments or seeking preventative strategies, Altus provides comprehensive solutions tailored to meet your needs.

Our expertise in B2B debt collection ensures that you recover outstanding funds without jeopardizing business relationships. Through strategic methods and compliance with all regulatory requirements, we’ve built a reputation as Atlanta’s trusted commercial collection agency.

Whether you need 1st party receivables management to enhance your internal processes or 3rd party collection services to tackle more complex cases, Altus has you covered. Our team acts as an extension of your business, prioritizing transparency and efficiency.

When traditional debt recovery efforts aren’t enough, Altus partners with commercial attorneys specializing in escalated collections. Our seamless legal escalation process ensures that legal actions are pursued in an ethical and professional manner to maximize recovery rates.

Atlanta’s global presence continues to expand, and so does our expertise. Altus offers international debt collection services, enabling businesses across Fulton County to collect outstanding payments from clients worldwide.

Businesses in Atlanta can rely on Altus to manage credit insurance claims collections effectively. We streamline this complex process to ensure you recover funds as quickly as possible.

Before extending credit to new customers, businesses in Atlanta can benefit from our tailored asset and liability reports. These insights provide valuable risk assessments, ensuring smarter decisions and greater financial stability.

Atlanta is known for its diverse economy, and at Altus, we are proud to serve businesses across a wide range of industries. Whether you’re part of the thriving construction sector, bustling transportation network, or the innovative tech and SaaS community, our services are designed to meet your industry-specific challenges.

We have extensive experience in industries including:

No matter the size or focus of your business, Altus brings expertise and industry knowledge to help recover what you’re owed.

At Altus, we combine advanced technology, data insights, and industry expertise to deliver results. Here’s how we work:

This streamlined approach ensures that your business recovers funds efficiently without unnecessary stress.

A collection agency is a business entity that specializes in recovering overdue or unpaid debts from individuals or companies on behalf of creditors. When a customer fails to pay their bills or meet their financial obligations within the agreed terms, lenders or service providers often turn to collection agencies to secure payment in a timely and efficient manner. These agencies utilize a variety of tactics, including phone calls, emails, and written correspondence, to remind debtors of their obligations and negotiate repayment.

Collection agencies serve an essential role in mitigating the financial risk for businesses by recovering money that would otherwise result in a loss. Instead of dedicating time and resources to chasing unpaid accounts, creditors can focus on their core operations while entrusting debt recovery to professionals. Consumers, too, can benefit from working with a collection agency, as many agencies are skilled at crafting flexible repayment plans that make settling debts more manageable.

It’s important to note that reputable collection agencies adhere to strict guidelines and laws, such as the Fair Debt Collection Practices Act (FDCPA), to ensure ethical and lawful recovery methods. Transparency, professionalism, and a focus on solutions are hallmarks of a good agency, creating outcomes that benefit both creditors and debtors. With their expertise, collection agencies provide an indispensable financial service that helps businesses maintain cash flow and sustain growth.

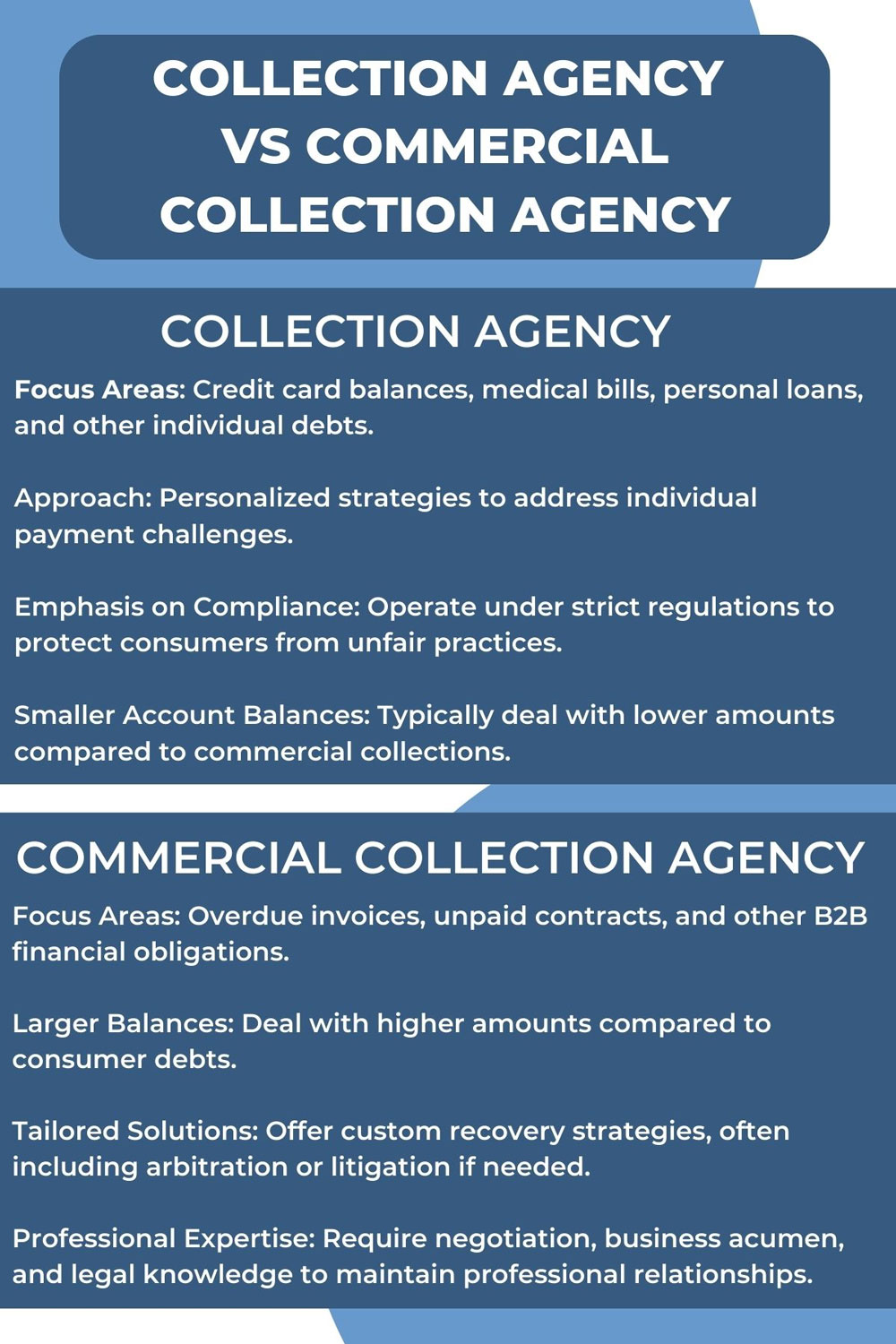

Traditional collection agencies focus on recovering consumer debts—amounts owed by individuals. These agencies typically handle smaller account balances and work directly with consumers to resolve payment disputes. Here’s what sets them apart:

Traditional collection agencies are experts in handling consumer-focused debt recovery while navigating the complexities of personal payment disputes.

Commercial collection agencies specialize in recovering business-to-business (B2B) debts. They handle more complex cases where unpaid invoices or contracts between companies are involved. Here’s what makes them unique:

Commercial collection agencies go beyond debt recovery—they aim to protect ongoing business relationships while resolving financial disputes efficiently.

Choosing the right agency depends on whether you’re dealing with consumer or business debts, the size of the balances, and your recovery goals.