Your Next Commercial Collection Agency in Philadelphia, PA

Altus: Turning Debt Challenges into Financial Solutions

Start Collecting Efficiently With Altus

Start Collecting Efficiently With Altus

When you’re seeking a trusted commercial collection agency in Pennsylvania, Altus Commercial Receivables is the partner you need to safeguard your financial health. With an office located right here in the City of Brotherly Love, we’re not just any B2B collection agency—we are your local experts in resolving debt challenges with professionalism, efficiency, and results.

At Altus, we know the pulse of Philly’s vibrant marketplace and what it takes to thrive here. Whether you’re a growing small business or a large enterprise, we’ve got your back with receivables management services designed to keep your cash flowing. Struggling with overdue invoices? Need a smarter strategy to handle commercial receivables? We’re here to help you recover B2B debt and stay ahead. Let Altus take the hassle out of collections so you can focus on what you do best—growing your business.

Ready to take control of your cash flow? Don’t settle for anything less than the best. With a physical office right here in Philadelphia, we bring local expertise with the power of a national reach to help you hit your debt recovery goals.

At Altus Commercial Receivables, we’re proud to be the trusted B2B debt collection partner for Philly businesses.

Give us a call or contact us today. Let’s work together to secure your financial future and get your business back on track!

Altus offers comprehensive solutions to help businesses manage unpaid invoices and overdue accounts with expertise and efficiency. Our services are designed to optimize your financial health and ensure smoother cash flow, whether you need early intervention or full-scale recovery support.

Philadelphia’s spirit of innovation and grit is reflected in the diversity of industries buzzing across the city. With expertise in sectors like construction, manufacturing, technology, transportation, agribusiness, and more, Altus ensures your industry-specific needs are met with precision and clarity. For debt collection for small businesses or Fortune 500 firms, our solutions help protect what makes your Philadelphia business thrive.

Unlike other B2B collection agencies, Altus goes beyond mere debt recovery. From business credit reports to asset and liability reports, our services provide critical insights to help you make informed financial decisions today and in the long run.

A collection agency is a business entity that specializes in recovering overdue or unpaid debts from individuals or companies on behalf of creditors. When a customer fails to pay their bills or meet their financial obligations within the agreed terms, lenders or service providers often turn to collection agencies to secure payment in a timely and efficient manner. These agencies utilize a variety of tactics, including phone calls, emails, and written correspondence, to remind debtors of their obligations and negotiate repayment.

Collection agencies serve an essential role in mitigating the financial risk for businesses by recovering money that would otherwise result in a loss. Instead of dedicating time and resources to chasing unpaid accounts, creditors can focus on their core operations while entrusting debt recovery to professionals. Consumers, too, can benefit from working with a collection agency, as many agencies are skilled at crafting flexible repayment plans that make settling debts more manageable.

It’s important to note that reputable collection agencies adhere to strict guidelines and laws, such as the Fair Debt Collection Practices Act (FDCPA), to ensure ethical and lawful recovery methods. Transparency, professionalism, and a focus on solutions are hallmarks of a good agency, creating outcomes that benefit both creditors and debtors. With their expertise, collection agencies provide an indispensable financial service that helps businesses maintain cash flow and sustain growth.

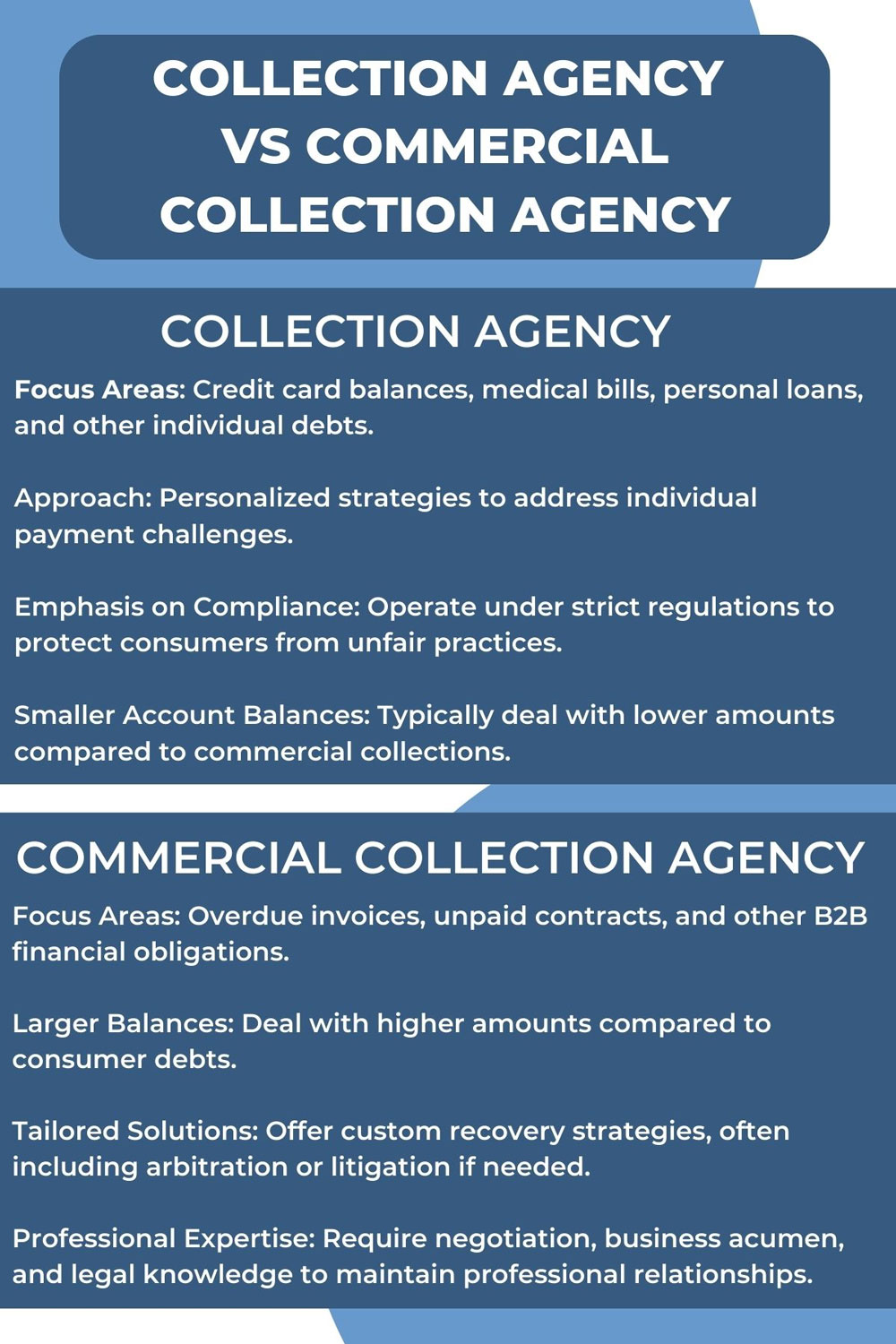

Traditional collection agencies focus on recovering consumer debts—amounts owed by individuals. These agencies typically handle smaller account balances and work directly with consumers to resolve payment disputes. Here’s what sets them apart:

Traditional collection agencies are experts in handling consumer-focused debt recovery while navigating the complexities of personal payment disputes.

Commercial collection agencies specialize in recovering business-to-business (B2B) debts. They handle more complex cases where unpaid invoices or contracts between companies are involved. Here’s what makes them unique:

Commercial collection agencies go beyond debt recovery—they aim to protect ongoing business relationships while resolving financial disputes efficiently.

Choosing the right agency depends on whether you’re dealing with consumer or business debts, the size of the balances, and your recovery goals.